On October 30, 2024, Chancellor of the Exchequer Rachel Reeves of the UK Labour authorities unveiled a extremely anticipated finances that despatched ripples throughout a number of sectors, particularly the electrical automobile (EV) business.

In opposition to a backdrop of financial challenges, the federal government’s £40 billion finances announcement sparked curiosity and concern for EV homeowners, business leaders, and environmental advocates.

Whereas the finances was seen as a blended bag, sure measures aimed to encourage the expansion of the EV sector, though some urgent points, resembling cuts to public charging VAT, went unaddressed.

This text dives into the important thing takeaways from the finances, analyzing how these adjustments influence EV homeowners, companies, and the broader inexperienced transition.

Tax Rises

The headline of this finances was undoubtedly the numerous tax rises, with over £40 billion launched throughout varied sectors.

EV stakeholders might view these will increase as obligatory measures to counter the financial pressure, however for these hoping for incentives to offset rising EV possession prices, the finances had restricted information to supply.

The concentrate on tax raises aimed to stabilise the economic system, however the direct influence on EV incentives was refined.

Gasoline Responsibility Freeze

Regardless of pre-budget discussions suggesting a doable improve, gas obligation stays frozen, persevering with a coverage that has resulted in over £80 billion in foregone income since 2011.

For EV proponents, the freeze represents a missed alternative to discourage inside combustion engine (ICE) utilization and shift momentum towards electrical alternate options.

The federal government’s choice to maintain gas obligation regular might resonate with ICE automobile homeowners going through monetary pressures, but it underscores the dearth of extra help for these transitioning to EVs.

For EV homeowners, charging prices proceed to differ considerably relying on entry to house charging.

Charging at house stays by far the most affordable choice for refuelling an EV, permitting homeowners to reap the benefits of off-peak electrical energy charges, saving considerably over time in comparison with public charging.

Nevertheless, many EV homeowners, particularly these in city areas or with out driveways, lack the choice to cost at house.

For these drivers, various options like charger sharing schemes, resembling Joosup accessible for iOS and Android, presents a sensible and cost-effective method to cost.

Joosup connects EV homeowners with native hosts who share their personal chargers, enabling handy entry to charging at extra inexpensive charges than many public choices.

These group charging platforms are more and more beneficial as they not solely cut back charging prices but in addition broaden charging availability in areas underserved by public infrastructure.

Within the present financial local weather, such revolutionary options present a significant method to help the rising variety of EV drivers with out devoted house charging amenities.

BIK Extension Till 2030

For EV homeowners and companies, one optimistic consequence from the finances was the extension of Profit-in-Form (BIK) tax aid on electrical autos till 2030.

BIK, which permits companies to supply EVs as a tax-efficient profit, has been prolonged with a gradual improve in charges as much as 9% by 2030.

This measure provides readability for companies and people trying to decide to EV leasing and wage sacrifice schemes, offering long-term visibility for EV customers regardless of the gradual rise in BIK charges.

In comparison with ICE automobile charges, EV BIK charges stay considerably decrease, underscoring the federal government’s intent to encourage EV adoption within the company sector.

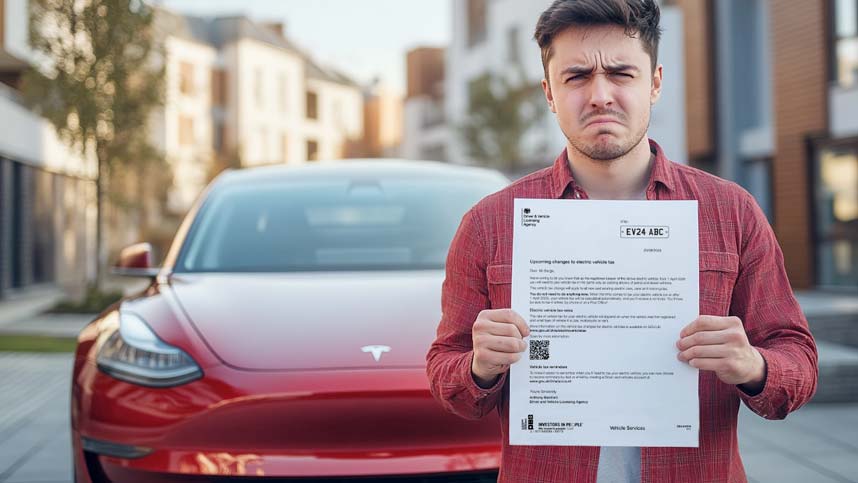

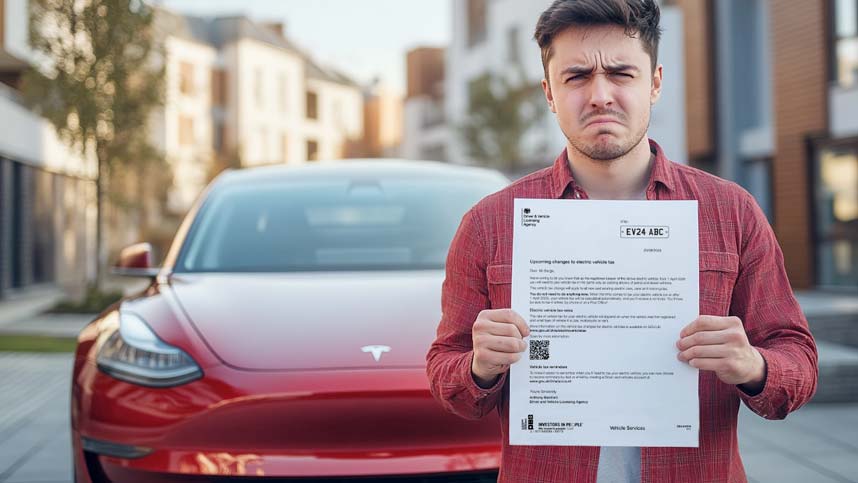

First-Yr VED Charges

From 2025, EVs will now not be exempt from Car Excise Responsibility (VED), a call launched by the earlier authorities.

Below the brand new construction, EVs will face first-year VED costs, although the charges stay comparatively decrease than these for ICE autos emitting over 76g/km CO₂, which is able to double.

Whereas the upcoming VED adjustments replicate the federal government’s intention to create a balanced tax method, they add a brand new price consideration for potential EV patrons.

Notably, the federal government has opened a session concerning the controversial ‘Costly Automotive Complement’ in VED, which might doubtlessly convey extra beneficial changes for EVs sooner or later.

100% First Yr Allowances Prolonged

The finances introduced a welcome extension of the 100% first-year allowances for zero-emission automobiles and EV cost factors, now accessible till March 31, 2026, for Company Tax and April 5, 2026, for Earnings Tax.

These allowances enable companies to offset their investments in zero-emission autos and charging infrastructure, decreasing tax liabilities within the first 12 months of buy.

Whereas the extension is momentary, it continues to encourage corporations to make sustainable investments, particularly in fleet electrification and office charging options.

Plug-in Car Grants

In a lift for EV vans and accessibility, the federal government introduced a £120 million fund for plug-in automobile grants.

These funds are earmarked for electrical van purchases and the event of wheelchair-accessible EVs, a step that recognises the rising demand for sustainable choices within the industrial and accessible transport sectors.

Given the provision points within the van market, this grant gives important aid, guaranteeing companies and people can transition to electrical vans with some monetary help.

Assist for Gigafactories & EV Rollout

To strengthen the UK’s EV ecosystem, the federal government pledged £2 billion to help the automotive sector, with a concentrate on gigafactories and EV rollout.

Though particulars stay restricted, this funding aligns with the broader trendy industrial technique, designed to boost the nation’s capability for battery manufacturing.

Gigafactories are crucial to decreasing EV manufacturing prices and securing a steady provide chain, which might assist the UK meet the rising EV demand domestically and internationally.

Speed up EV Chargepoint Rollout

One of the vital promising bulletins for EV homeowners was the allocation of over £200 million in 2025-26 to speed up the rollout of EV cost factors.

This funding goals to help native authorities in establishing on-street charging stations throughout England, making EV charging extra accessible to city and rural drivers alike.

The extra funding builds on earlier schemes, such because the Native Electrical Car Infrastructure (LEVI) fund, guaranteeing that handy and dependable EV infrastructure expands as EV possession grows.

The federal government additionally confirmed that on November 24, new public cost level rules would come into impact, mandating reliability requirements and knowledge transparency for cost factors.

This regulatory shift is predicted to boost person confidence, addressing considerations over cost level availability and performance.

Conclusion

The October 2024 finances delivered blended outcomes for the EV sector.

Whereas tax rises and the continued gas obligation freeze upset these hoping for bolder pro-EV insurance policies, a number of initiatives supplied optimism.

The extension of BIK aid, VED changes, and elevated funding for EV cost factors and gigafactories point out a dedication to a long-term EV transition.

Nevertheless, the absence of extra incentives, resembling VAT reductions on public charging, left some within the business questioning the federal government’s prioritization of EV progress.

Because the UK continues its journey towards net-zero, this finances serves as a pivotal second, with each challenges and alternatives for the EV sector.

For now, EV advocates and business leaders are hopeful that these measures will drive continued funding and client adoption, bringing the UK nearer to a completely electrified future.